Palladium Notes

Here you can read our prospectus for the creation of a Palladium backed private currency.

Introduction

The concept of a private currency pre-exists the concept of legal tender. Private currencies are the origin of all currencies. Originally they were private measures of known commodities. The first state backed currency was the measured standard weights of silver nuggets minted by the Assyrian Empire in the 8th century B.C.. To these, there succeeded the coins minted by the Greek States of Asia Minor in the 7th century B.C.. The minting of coins was at start a private affair. Later their minting was reserved to authorities with temporal jurisdictions.

With the invention of Bank notes, private banks issues their own script as a surety that they would pay on redemption. In the 19th Century, private banks in the U.S. A. all printed their own Bank Notes in US Dollars, as private currencies, as the U.S. Federal Reserve Bank of Cleveland reminds us.

Our Proposal: Palladium

With the increasingly uncertain future of the principal fiat currencies of the world, which are continually being intentionally devalued by the national or transnational governments which issue them, there is a real economic need to have alternate currencies. The phenomenon of cryptocurrencies is part of this response. But cryptocurrencies are highly volatile since any mathematical system for generating primes is limited to a near finite number of solutions knowable to man. For that reason, private currencies backed by real valued commodities or metals are much better medium of exchange.

Of all the precious metals, few have the characteristics of stability in value and abundance to maintain a high value, than the precious metal Palladium, which is extracted in the production of nickel or silver refining. Unlike Silver, it has a high value. Unlike Gold it does not have as common industrial or commercial uses, and it is not as speculated. Also, it is a metal which as of now is rarely used as a reserve metal for national banks.

The abundance of Palladium also makes it a metal capable of reserve, since it is neither too rare nor too abundant to cause its to be a reference value for a private currency.

Thus, the solution is a private currency backed by Palladium.

Our Proposal: The PalladiumBANQ

To facilitate and enable our private Palladium backed currency, we propose the foundation of a corporation which would act as a private authority for the issuing of the currency, called the PalladiumBANQ. A single word to avoid the legal misconception that it is a Bank, subject to Banking laws. But likewise to signify that it would have the duty to maintain the value of the private currency and guarantee the authenticity of the notes used. We estimate that an initial investment of $10 Million Dollars US would be necessary to establish such an institution in the USA.

The PalladiumBANQ would print and issue the notes and guarantee their exchange for Palladium or in other recognized currencies or cryptocurrencies. It would reserve a quantity of the precious metal to back each note sufficiently, to guarantee its value in milligrams of palladium. It would contract with financial institutions world wide for the recognition and exchange of Palladium Notes, which it issues. Finally, it would establish, maintain and oversee the security features necessary to prevent counterfeiting.

A Concept of Design

What would such a private currency be like?

Our Palladium Notes would be a private currency (or voucher) denominated in grams (or milligrams) of the precious metal Palladium (Atomic symbol: Pd), and printed in full color security paper measuring 3 by 5 inches, protected by 5 security measures and a non sequential serial number unique to each note and edition. Bearing the words “Not Legal Tender” they conform to U.S. Federal and State Laws against fake currencies and unregistered securities.

The sale of these notes would be offered in exchange for real currencies or cryptocurrencies. Upon the sale, the funds received in exchange would be placed in an Escrow Account of the PalladiumBank, used to acquire the palladium metal sufficient to back the note to full value, so as to secure the repayment of the Note upon redemption.

The PalladiumBank by its endorsement on the observe of each note would guarantee contractually to redeem the note for cash (in those countries where private currency is not unlawful) at the value had by the weight of the precious metal Palladium indicated on the note. Thus a 1 Gram note will be held to have always the value of the spot price* of 1 gram of palladium. These notes would be denominated in Palladium to avoid the U.S. Treasury laws against denominating private currency in U.S. Dollars and to provide for a value for each note which is independent of any legal tender or private currency already in circulation. Note Well: this means that the value of each Note will fluctuate with the spot price of Palladium. The PalladiumBANQ and its successors in Law will regard these notes as having the stated value in perpetuity.

The Palladium Notes would feature artistic montages commemorating the Crusades of Old and the famous Catholic Crusaders and Clergymen who participated in them to honor the memory of their heroic deeds, without constituting an endorsement of their less valorous accomplishments.

These notes would then be for sale to the general public. Their sale would be recorded and registered on the books of the PalladiumBANQ corporation so as to comply with U.S. Laws against knowingly creating a system of money exchange which is unregistered and thus liable to use by money launderers. This registration will also assist PalladiumBANQ in authenticating the notes and investigating any possible crime that may be committed in their use or theft.

In countries where private currencies are not permitted by present existing laws, but other forms of script are, such as gift certificates, PalladiumBANQ would establish subsidiaries which would offer notes under those forms of script for use in the economy. — Where local laws require or change requirements, PalladiumBANQ would alter the nature of the note and its specificiations to remain legally usable and protecting the value of all previous issued noted.

Notes would be redeemed and sold via an app, so that from any Point of Sale with a simple scan of a cellphone a purchase and sale can be authorized and registered in the central registry of PalladiumBANQ. Each note would have QR and Barcode to facilitate this and verify the authenticity of each note, each of which would bear a unique non-sequential alpha-numeric serial number, series name, date of issue. — This would prevent the notes being used in money laundering and criminal schemes.

+ + +

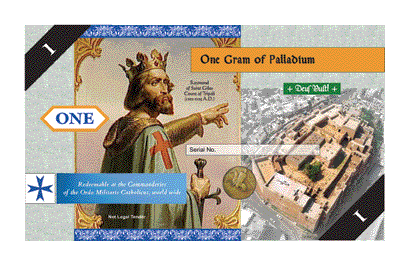

1 Gram Palladium Note

The obverse of our 1 Gram Palladium note features Raymond of St. Gilles, the Count of Tripoli

For more

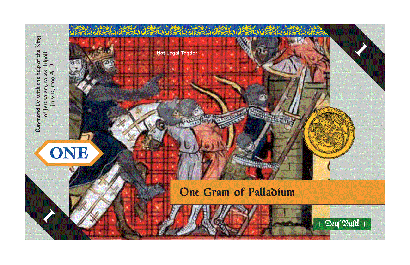

The reverse of our 1 Gram Palladium note features the siege and capture of Tripoli by the combined forces of Godfrey of Bouillon and Raymond of St. Giles.

+

For More Information, prospective investors are invited to contact our offices

____________________

Spot Price of Palladium: By spot price we mean the spot price at New York, USA, of 1 troy ounce of palladium divided by 31.1034768 grams per troy ounce, not the spot price of dealers who sell 1 gram palladium bars. – The images above are only to give an idea of what such notes could look like and do not represent any read note in print or circulation.

© 2019 – 2024, Ordo Militaris Inc.. All rights reserved. Certain incorporated images are public domain.